Billing and Statement > Discounts

Discounts can be confusing, so it's important to understand them before offering discounts as an option.

Some companies offer some or all receivables customers a statement-based discount to encourage on-time or early payment. We refer to this as a "statement" discount.

First, it's important to understand that discounts are rarely a direct percentage of a customer's balance or even a particular sale's total. There are many reasons for this which we will explain in this topic. This is a primary point of confusion regarding billing.

Another key point is that discounts are always calculated at time of invoicing (Point of Sale). Discounts are never calculated from a customer's balances. Later activity such as posting or billing processing neither calculates nor re-calculates discount amounts; however, it is possible for posting and billing to affect discounts in other ways:

-

In certain cases, posting allows a user to override a customer's discount and apply either more or less discount than the customer is considered eligible for (except in the case of POS Invoice Terms which offers no ability to override the discount).

-

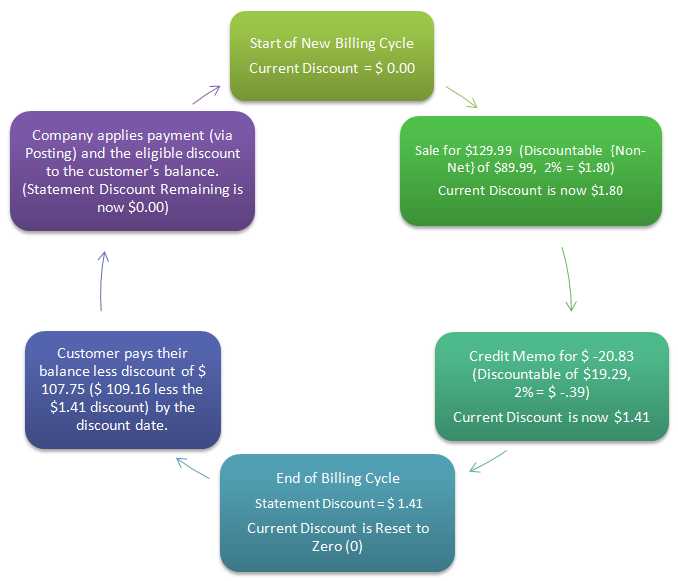

Billing processing also affects discounts but not in the sense of any recalculation. When the Billing cycle closes, any existing discounts that were not taken/used during the previous cycle are cleared and new "statement" discounts are set equal to each customer's "current" discount (if positive). After this, the "new" or current discount is zeroed for the beginning of the new cycle. A customer's "current" discount is always zero at the beginning of each billing period (cycle).

Statement discounts are enabled by account, job, or individual invoices (in some cases). Discounts are indicated for a customer by by designating a non-zero discount percentage for the account or job.

How Discounts are Calculated at Point of Sale

At Point of Sale, all discounts are calculated on the non-net total of the sale and may, or may not, include sales tax. If you designate some items as "net" (or "not discountable"), the extended amounts for those products won't be considered when calculating a customer's discount on a sale. Many Point of Sale transactions and documents use an "N" column to indicate the "discountable" status for each item. The discountable flag on items prevents any line-item discounts and is used for the calculation of statement discounts. This does not prohibit manual changes to pricing or the use of the Reprice (F6) function during a Point of Sale transaction, however. Furthermore, sale pricing, contract pricing, and group discounts, for example, are all considered part of the customer's normal price when indicated. The "discountable" or "net" flag doesn't consider special pricing a discount.

With regard to sales tax, a parameter determines whether or not sales tax is considered in the calculation of statement discount. Including sales tax might make discounts less confusing for customers since it makes it more likely that the percentage will be closer to the invoice total; however, if you use "net" or non-discountable items, it probably won't make much of a difference as far as confusion goes. Either including or not including sales tax in the discount calculation does not make any difference as far as your company's sales tax liability.

Discounts which are given directly and immediately (at time of processing) at Point of Sale do reduce your tax liability because your company is charging less for the goods. However, since there is no guarantee that a customer will pay on time and receive their discount, sales tax cannot be reduced based upon the "possibility" of a future statement discount.

How Credits and Returns Affect Statement Discounts

Standard Discounting

With standard statement discounts, credit memos (returns) reduce the customer's current discount immediately when the return (credit) is processed. This does not reduce the customer's statement discount; however, in most cases, the customer's next statement discount will be reduced by the amount of the credit. Because a negative (credit) discount is never carried forward to a new billing period, there are scenarios where this method will benefit either your company or the customer.

|

COMPANY BENEFITS |

One example of this is when a customer makes a single purchase in one billing period and returns the entire purchase in the next consecutive period and this occurs before the customer receives or pays their bill (statement). This results in a positive figure in "statement" discount and the same figure as a negative amount in "current" discount.

Because the credit equals the sale amount, there is no way to apply the discount as there would have been if the customer remitted payment less their discount. After automated or manual posting, both discounts remain but offset each other. This is a wash and won’t affect the customer or your company in a negative way unless the customer makes another purchase during that cycle. In this case, the negative current discount will cause a reduction in the customer's future statement discount. The customer is not likely to make any payments since their balance is zero, so the previous statement discount is never applied.

In this case, your company benefits, but the customer lost some of the discount they should have been eligible for.

|

CUSTOMER BENEFITS |

An example of when the customer benefits is when the customer is open item and returns merchandise after having paid their balance in full and receiving their discount. Another condition is that the customer's return is either the only activity in the month or their total discountable charges are less than the total discountable credits. In this case, any negative (credit) current discount won't be carried forward to the next billing period (statement discounts are not allowed to be negative). This means that the customer received the benefit of their discount on the original sale but did not receive any penalty for returning those goods.

In this case, the customer benefits from both their discount and the full credit amount without any penalty for returning the products.

Balance Forward accounts are able to carry a negative balance. If an automatic post/apply of credits is processed for a balance forward account with only a credit balance (no other balances), the credit balance is reduced to zero and the current balance is set to a negative figure by the amount of the applied credits less any discount. As long as there is no other activity, the result is that the customer’s credit is reduced by the discount for the next billing cycle.

In either of the cases explained above, your company could correct the account by issuing either a credit (company benefits) or debit (customer benefits) adjustment for the amount of discount that should have been given or reduced. Credit and debit adjustments remain on the account until posting activity applies or posts payment toward the adjustment.

Posting Receivables and Discounts

We've already mentioned that all statement (aka. early/on-time payment) discounts are calculated at time of invoicing; however, discounts aren't applied until credits are posted to an account within the discount period/terms. In most cases, the user responsible for posting payments can manually override the discount amount either by granting discount after the discount date, increasing/decreasing the discount amount applied, or by disallowing the discount entirely. This override ability is not available when automatically posting payments (auto-apply).

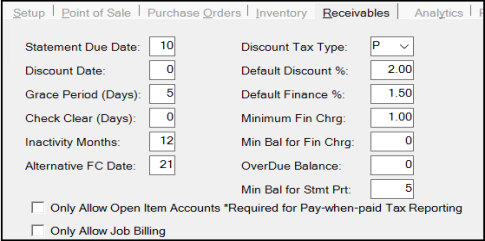

The discount period is defined by the Discount Date Receivables parameter. The number designated is the day of month in the following (next) billing period after the invoice is processed, not a number of days.

Receivables Parameters (Detail)

Another parameter, Grace Period (Days), is optional and can be used to indicate an automatic extension of the discount period. If used, customer's who remit payment after the discount date but before the # of days "grace period" will still receive their discount (unless overridden during manual posting). The Check Clear (Days) is similar except that it works in the opposite direction. "Check Clear (Days)" adds the number the days indicated to the posting date of payments to allow time for a check to be deposited and clear the bank. The "posting date" of the payment is used for determining discount eligibility, so this can affect whether or not the payment is considered to be within the discount period.

It makes the most sense to use either "grace period" or "check clear" but not both, since they can effectively negate each other and cause confusion. Neither is required. In all cases, the user posting payments can override the discount period by adjusting the "posting date" of the session.

Discounting

The following bullet points list various considerations and important points about statement discounts:

-

Current, and in turn Statement discounts, are based upon the discountable amount or non-net total of the sale or credit.

-

Discounts aren't necessarily a direct percentage of either the subtotal or total (if tax is included).

-

Discounts are never calculated from a customer's overall balance.

-

It is possible for a transaction that mixes both sales and returns of merchandise to produce either a positive or negative discount regardless of whether the transaction winds up being a charge or credit (return). This is possible because discounts are calculated on the “non-net” total. The discountable total might be positive or negative depending upon the nature of the items being returned vs. sold. To avoid any later confusion, we suggest not mixing returns and sales together... especially when discounts are involved.

-

Sales tax may optionally be included when calculating the discount; however, this does not reduce the sales tax liability for your company. Discounts only change the amount the customer will pay (if they pay on time).

-

Statement processing is not responsible for the calculation of discount amounts. Discount amounts are determined by the customer’s assigned statement discount percentage at time of invoicing.

-

Existing statement discounts that have not been taken (applied) are not carried forward.

-

Credit (negative) statement discounts are not permitted. Only the current discount can be negative. If current discount is negative at the time of the billing cycle close, the new statement discount will be zero.

-

Current Balance can only be negative for Balance Forward accounts. If a balance forward account’s current balance becomes negative as a result of posting activity, the balance reduction is based on the credit total less the credit’s discount.

-

Discounts are not initially calculated by posting activity; however, posting activity can affect both the remaining amount of statement discount as well as the current discount. It is also possible to apply more discount than the amount calculated for any given customer.

-

When applying credits to an open-item "job billing" account and using the "consolidated" option in Posting, the software will ask (prompt) the user as to whether or not discounts should be auto-filled. In the case of a "job billing" type account, statement discounts are maintained separately for each job. The open item listing will include charges (open items) for all jobs, so the handling of discounts can be trickier (invoices are updated with the amount of discount applied to them if the account is open item and eligible for discounts). In this case, no manual adjustments to the discount being applied are allowed (to do so, you must apply credits by job). Here are the conditions that must be met before any discounts are applied in this case:

•The account’s remaining “statement” discount is greater than zero (account’s statement discount less the statement discount applied).

•The job’s remaining statement discount is also greater than zero (job’s statement discount less the statement discount applied).

•The invoice is not for the current cycle and is not a debit adjustment.

•The invoice’s statement discount is less than the job’s remaining discount (statement discount less the job’s applied discount).

Note: “Current” discounts are never considered or applied in this case.

Assuming the above conditions are met, the apply amounts would then be reduced by any applied discount and the "discount" text area (on the Posting form) would reflect the total of all discounts applied. The amount of discount applied is maintained for each invoice; however, it is not shown. Individual discounts would be the difference between the "balance" and "apply" column values for the invoice (row). Because the discounts are maintained separately for each job, the discount to apply cannot be manually set in this case. The discount text-area will be read-only to prevent changes.

-

The reduction of the customer's "current" discount by credit memos (returns) is not based upon whether or not they actually receive or received their statement discount. The posting date of payments can affect whether or not statement discount is applied. If a customer pays late and doesn't receive their discount, this won't change the fact that any credit memos (returns) reduce the customer’s future statement discount for the next billing period.

-

The Grace Period and Check Clear Days parameters can affect whether or not discount is allowed. Receivable users should be made aware of how these parameters affect discount eligibility if either of these parameters are set to a non-zero value.