Change Log

This is a list of changes made in version 12.18 and subsequent sub-releases. To view a list of major features only, navigate to Major Features.

12.18.0

12.18.0

Added / Changed

B-78549 - International Feature : The software will no longer print a blank page after the printing of each document when the A4 paper size is used.

Fixed

D-59684 - Inventory : For UK users within the Code Definitions screen the default piece and default cubic meter fields will now appropriately populate. For all users all label headings are now visible, and duplicate values are no longer allowed.

D-65312 - e-Commerce API : The GetItemDetail method will now correctly return information for the indicated item, as opposed to the first item in inventory.

12.18.1

12.18.1

Fixed

D-65112 - e-Commerce API : The ItemDetail model now contains the full item description, rather than the short description.

12.18.2

12.18.2

Added / Changed

B-77884 - Option to Record Retained Earnings entries only when Income Statement accounts are present in the transaction : This new feature allows multi-department systems to avoid retained earnings activity on branch-level retained earnings accounts when the transaction does not affect the Income Statement. Though any journal hitting Net Income will still generate such entries, this will restrict unwanted branch-level retained earnings activity for situations where it’s not useful to have such activity—essentially, if the only accounts affected in a transaction are balance sheet accounts (assets, liabilities, and owner’s equity), with this setting enabled, the application won’t make a retained earnings entry, even if departments vary and branch mapping is enabled.

B-83743 - Potentially Dangerous File Type Attachments Restricted : Added restrictions on the ability to attach potentially dangerous file types within the Attachments database. Going forward only the following file formats will be allowed:

Common image file formats allowed include: *.PNG;*.BMP;*.JPG;*.JPEG;*.GIF;*.TIF;*.TIFF; and *.RAW.

Common Office file formats allowed include: *.PDF;*.DOC;*.DOCX;*.XLS;*.XLSX;*.PPT;*.PPTX;*.ODT; and *.ODS.

Other file formats allowed include: _PDF; *.PDF-; *.PDF_; *.1PDF; *.-1PDF; *.MSG; *.TXT; *.EML; *.DOTX; *.MAX; *.CIP; *.HTM; *.HTML; *.RTF; *.ZIP; *.MHT; *.HEIC; *.WAV; *.XML; *.XLSM; *.ASPX; *.CSV; *.XPS; *.URL; *.COM/; *.PHP; *.PAGE; *.XLTX; *.SPV; *.ASP; *.NET; *.DXF; *.CRYPT; *.OXPS; *.1; *.COM; *.ICO; *.M4A; *.INI; *.KIT; *.DAT; *.JFIF; *.MP3; *.MP4; *.DWG; *.BAK; *.DOT; *.PD~; *.HTM#; *.; *.CC; *.ECP; *.QSB; *.LOG; *.VCF; *.MOV; *.DB; *.CFM; *.P; *.TMP; *._PDF; *.0; *.JSP; *.RPT; *.2; *.PAGES; *.PRN; *.UDL; *.AVI; *.ES1; *.WOAK; *.72; *.EST; *.001; *.012; *.10; *.3; *.ARP; *.JS; *.MOORE; *.PCX; *.PD; *.PLAN; *.PSD; *.SVM; *.WPS; *.XST;*.$BB; *.TX; *.01; *.022; *.1& ZW; *.269; *.27; *.4; *.94; *.AI; *.CA/; *.COM; *.HARMA; *.PFD;* .RRD; *.S; *.SHS; *.WMV; *.00; *.009; *.00969; *.0100; *.01038; *.01071; *.0108; *.03; *.2611; *.32313; *.45; *.584; *.5961; *.71; *.91; *.99); *.A; *.C; *.CSS; *.GNH; *.IFX; *.M; *.MCE; *.RAR; *.SHTML; *.SNAG; *.SPR; *.XLK; *.; *.I; *.#; *.1; *.30"; *.~TMP; *.0098; *.0113; *.02;* .12; *.1589; *.20; *.254; *.26); *.268; *.2SQ; *.3074; *.34706; *.41; *.43542; *.5; *.50); *.55; *.6; *.68; *.7; *.75576; *.8; *.99; *.ACK; *.APK; *.BIZ/; *.CO; *.COM-; *.EM; *.HT; *.HTML#; *.MSTI; *.ONE; *.OUT; *.PDB; *.PDSF; *.PHP#; *.PKG; *.PLN; *.PTN2; *.PUB; *.SQL; *.SYS; *.T; *.THEME; *.UTS; *.WEBP; *.XLSB; and *.XLT.

B-83742 - Security Update : We have removed the URL from “Help, About”. The link text remains.

B-84560 (UK Only) UK VAT Electronic Submission Fraud Prevention Headers : In compliance with the United Kingdom’s HMRC regulation changes dated 6 January 2021, submission of VAT information now includes mandated Fraud Prevention Headers.

B-84585 - Default Currency for Payables (Scheduling) : If Multi-currency is enabled on a system and a vendor with a non-store-default currency is listed in the Accounts Payable Schedule Payments grid, payment amounts displayed will now be in the vendor’s currency, resulting in totals for currency-specific check runs that accurately reflect what will be paid in the checking account’s currency. In addition, the “Pay Amount” column heading will be “Foreign Amt” to highlight the display of amounts in the foreign currencies, and foreign-currency discounts and amounts will be displayed in blue for clarity.

B-84587 - Payables Scheduling : The estimated discount [“Disc (est)”] and pay amount columns in the Payables, Schedule Payments form will now display in the given vendor’s currency instead of the user’s local currency. Additionally, any currency which is not the local currency will be easily identifiable as it now renders in blue font.

B-85557 - API Enhancement: Tax Rate Adjustment on Import : When importing API orders and quotes, the application validates the incoming tax code as either the applicable "generic" tax code or a tax code applied by the appropriate tax service. The original tax rate on the order request is considered the priority if these two tax codes differ. Item or transaction detail changes respect the submitted tax rate. For more information, see Parameters > Point of Sale > Ecommerce Tab, Understanding the Totals Code.

B-86470 - API Enhancement: Added Notifications : Added new “Notify User or Group” parameter to allow a group or individual to receive e-Commerce order submission notifications.

B-87135 - API Enhancement: E-Commerce Quotes and Orders Report : New Active Report to allow review of e-Commerce quotes and orders, with date range, branch, document type, account, job, and minimum/maximum transaction amount filtering and an option to show item details.

B-87132, B-87134 - API Enhancement: E-Commerce Inquiry Improvements : New options in the Point of Sale > e-Commerce inquiry to allow filtering by date range, processed or pending status, Account/Job, and Dollar Value Range; added hyperlinks for Document # for e-Commerce-originated orders.

B-85206 - API Enhancement : Quotes and Orders Improvement Quotes and orders for non-stocked, special order items are now available by importing the API order record with non-stocked data into the application using the OrderRequestItem method in the API.

B-88637 - Material Lists : Material lists can be entered as a negative quantity in order to make return entry easier for products sold through a material list.

Fixed

D-62063 - General Ledger : If no GL department section is made for the Balance Sheet or Income Statement reports the report will be run for all departments. In this case “All Departments” will be shown in the output instead of a list of all departments.

D-69437 - Inventory : Entering the single quote (‘) character in the Lot field when receiving a lot-location item no longer results in an error.

D-68997 - Inventory : Random Length and Sheet Metal tally descriptions now show quantities and lengths.

D-63340 - Inventory : Special order labels printed from a Dymo will now print five lines (225 characters) when using the Description5 field.

D-70125 - Inventory : Some tabs in the POS F12 Process / remittance form were being colored inconsistently. Addressed this and made all tabs the same color.

D-63027 - Payables : Selecting the “Use Local Date Format” option from Parameters, Setup, Options, Miscellaneous now also ensures that the local currency symbol is used in the Billing Entry form.

D-665019 - Payables : When processing a Payable and selecting a receipt that is not linked to a purchase order (PO), use the selected pay-to vendor's default terms code and calculate and display the terms discount if any.

D-68849 - Payables (DevOps) : The “Payables: Open Receipts” Report run with selected branches will now only include receipts processed at the given branches.

D-66380 - Payables : We no longer validate the email address for direct ship email notifications. The software will attempt to send notifications to whatever address it finds on record.

D-67626 - Point of Sale : Quantity limits on Contract Pricing now function correctly again.

D-61787 - Point of Sale : Air Miles: when processing a Receive on Account payment for an Air Miles customer the tax is now correctly calculated.

D-68541 - Point of Sale : ACE Instant Savings no longer apply discount to point of sale transactions for Ace Instant Savings unless there is an active promotion.

D-67341 - Vendor EDI Change : Corrected an issue that was causing unpredictable behavior when loading Ace item images.

D-59634 - Vendor EDI Change : When a replacement item is received during PO Update for Orgill, don't add a new item if we can retrieve an existing replacement SKU using the SKU or barcode.

D-64378 - e-Commerce API : The e-Commerce API parameter form’s “Tax Code” and “Default SKU” selection boxes now populate correctly.

D-69452 - e-Commerce API : We no longer prevent the manual import of an e-Commerce generated order request based on account activity / inactivity.

12.18.3

12.18.3

Fixed

D-63336 - Inventory : When updating on-order quantities and considering transfers out, include only those with an “open” status.

D-65625 - Inventory : When importing a count worksheet, sorting in Physical Counts will now match that in the worksheet.

D-67580 - Point of Sale : Added extra logic, user messaging, and graceful handling of adjustment codes in POS transactions where there exists potential for duplication due to a default adjustment code existing on an included customer account.

D-70949 - e-Commerce API : Branch IDs of any length up to the 4-character maximum are now supported.

D-71099 - e-Commerce API : Units of measures in requests are no longer case sensitive.

12.18.4

12.18.4

Added / Changed

B-84585 - Default Currency for Payables Scheduling : If Multi-currency is enabled on a system and a vendor with a non-store-default currency is listed in the Accounts Payable Schedule Payments grid, payment amounts displayed will now be in the vendor’s currency, resulting in totals for currency-specific check runs that accurately reflect what will be paid in the checking account’s currency. In addition, the “Pay Amount” column heading will be “Foreign Amt” to highlight the display of amounts in the foreign currencies, and foreign-currency discounts and amounts will be displayed in blue for clarity.

B-84587 - Payables Scheduling Update : The estimated discount [“Disc (est)”] and pay amount columns in the Payables, Schedule Payments form will now display in the given vendor’s currency instead of the user’s local currency. Additionally, any currency which is not the local currency will be easily identifiable as it now renders in blue font.

B-88106, B-88107 Update to Support Trinidad-Based Check Printing : Added a new custom check form type that provides support for printing Trinidad-based checks and check forms. To set this option, contact ECI Support. After this parameter is set, the Voucher/Remittance Advice sections at the top and the Cheque section itself will print according to the Trinidadian required cheque settings.

B-90056 - HMRC Update : The ability to calculate a VAT adjustment for a transaction document by tax basis amount and direct a VAT adjustment to a specific, appropriate box on the VAT return.

B-90057 - HMRC Update : Ensures that the VAT Adjustments and transaction amounts excluded from the VAT Return display (or don’t display) appropriately in VAT Return boxes 7 and 9.

B-90059 - HMRC Update : The ability to view and print detailed VAT reports using Active Reports.

B-90061 - HMRC Update : A new VAT Return Excluded checkbox in the Billing Entry form gives you the ability to exclude zero VAT Payables from the VAT return. These entries will not be included in VAT Return boxes 6-9 when this checkbox is enabled.

D-72205 - HMRC Correction : The ability to select and view a finalised return without selecting the added step of clicking F8 View after the VAT return selection.

Fixed

D-70236 - HMRC Correction : Added the ability to select and view a finalised return without selecting the added step of clicking F8 View after the VAT return selection.

D-72293 - e-Commerce API : The API was returning the wrong unit pricing unit of measure, defaulting to the pricing unit rather than the stocking unit of measure . This has been corrected.

D-73064 - International Feature : In the St. Kitts and Nevis region and in Australia, the VAT taxable region label was set to VAT/GST in some forms. This has been corrected.

e-Commerce API Note : The GetTaxLocations and GetTaxLocationDetail methods will be deprecated soon.

12.18.5

12.18.5

Added / Changed

B-78644 - International Feature : The Billing Inquiry form will not show the foreign currency amounts associated with an invoice or a credit on multi-currency accounts using the Currency Differential method. Since the totals display in the local currency, this information is not necessary. The Billing Inquiry form will not display currency symbols associated with these amounts. When the Currency Differential method is disabled, the foreign totals and currency symbols will display in the Billing Inquiry form.

B-86335 - International Feature : We corrected an AP issue that occurred when backing out a vendor’s check amount when the invoice was paid using a foreign currency. The remaining amount on the invoice is now set correctly on a backed-out payables invoice.

B-92029 - Vendor EDI Change : LBM Advantage (formerly labeled ENAP) is upgrading their EDI FTP server and will now use a URL rather than the server’s IP address for managing EDI transmissions. Using a URL will ensure a smoother transition for all file transmissions when LBM Advantage upgrades servers in the future. ECI Clients can now use our updated EDI endpoint to access this new server URL.

Fixed

D-73405 - Royal Bank of Canada Card Restrictions in the Caribbean : Due to the credit card policy of Royal Bank of Canada (RBC), tokenized returns are not permitted for card payments in the Caribbean. We have removed this functionality from these transactions in ECI software to accommodate that policy. Additionally, when processing a return on an invoice that was paid with an RBC credit card in the Caribbean, the software does not prompt users to process the credit using the original card. However, when a customer asks for a refund through the RBC Card integration system, using the card as the return payment method, the refund transaction processes successfully.

12.18.6

12.18.6

Added / Changed

B-92645 - General Ledger : Updated 1099 Form Setup to Match Federal Changes : This year, the US Government has updated the structure of the 1099-NEC form, which businesses use to report payments to independent contractors. The new layout saves paper by including three records per page rather than the two-form format used in 2020. We have updated our system to use the 1099 Year entry in the EOY 1099-NEC form to choose the correct version for printing and electronic filing. Any reprints of 2020 1099-NEC forms will print properly using the older 2 forms per page format.

Note: We have resolved the spacing issues that were reported by some customers. When discussing this issue with Implementation or Support, reference D-78678 to learn more about this correction.D-74291 - Inventory : Received Item Cost Corrections Involving Foreign Vendors Now Show Local and Foreign Totals : In the past, when processing a Received Item Cost Correction involving a foreign vendor, the application displayed the calculation of the change in the local currency and reported the Final Cost in the foreign vendor's currency. To avoid confusion, we have changed this process to display the calculation in the local currency, reporting the result in the Final Cost field, and then displaying the foreign currency amount in a new field.

Fixed

D-73968 - International Feature Support : Submission Date Used to store HMRC VAT Return : When submitting a VAT return to HMRC (finalising), the submitted date is now updated to match the actual date/time of submission. Previously, it reflected the date/time that the VAT return was initiated, not submitted.

B-91904 - International Feature Support : Updates to VAT Adjustments Improve HMRC VAT Returns : Based on customer feedback, we have improved how we apply adjustments to a VAT Return for tax reporting to the HMRC using the Making Tax Digital (MTD) service. In the past, the application either included or excluded VAT adjustments based on the document's entry date. The exception to this rule was in the case of Payables, including vendor invoices or credits. In this release, we have adjusted the logic for VAT Adjustments involving Payables to consider the Payable's "billed date" rather than the document date. We will include VAT Adjustments if they reference a Payable (invoice or credit) billed either during or before the end of the VAT period, even if the payable is entered into the application after the reporting period has ended.

In addition, when you apply VAT adjustments to General Ledger journals, the application uses the cycle and fiscal year of the journal to determine the appropriate VAT period for the adjustment. Often, such adjustments may not occur until after the end of the reporting period. For example, for the reporting period May through July, if you enter a manual journal adjustment on August 10th for the prior cycle (July), the application would include a VAT adjustment in the May-July reporting period. This is true even though you created the journal adjustment after the end of the reporting period. This change allows you to make journal entries that affect the VAT Return for the prior period.

To summarize, the application uses the linked document's entry date to define the VAT period of a VAT Adjustment, with two exceptions.

For Payables, the application uses the Billed Date of the linked Payable, and

For General Ledger journals, the application uses the cycle and fiscal year of the linked journal

B-92459 Point of Sale: Quote and Order Processing Issues Resolved : One of our customers experienced intermittent validation issues when processing quotes and orders after upgrading to the current version. We corrected the code that caused the issue, which restored normal service.

D-74412 - Remaining Amount Was Set to 0 when Credit Still Remained : After the release of version 12.18.4, a Customer reported that the remaining balances on partially-applied credits were incorrectly set to 0. This issue impacted Accounts Payable and General Ledger records. This issue has been corrected for all accounts to ensure that all remaining credit amounts display correctly.

D-73853- Corrected Multi-Currency Issue when Paying Vendors in Foreign Currency : For businesses that use the Multi-Currency and Currency Differential settings, we noticed that some payments in the Scheduled Payments form to vendors who are paid in foreign currency were in blue, but the totals were in fact in the businesses’ local currency. We have corrected this issue and verified that the appropriate currency is displaying in the Billing Entry, Inventory Receiving, and Purchase Order Entry forms as well. The currency exchange for the two currencies must be established in the Point of Sale parameters to ensure the exchange rate is defined correctly. In the Vendor Maintenance form, the vendor’s Foreign Vendor check box must be selected and the Currency type chosen to ensure payments are issued successfully.

D-74379 - Changes to Discounts and Terms Options on AP Billing Entry Form : One of our Customers identified an issue in Accounts Payable Billing Entry after accepting a partial payment. Since discounts are not recorded in the General Ledger until the invoice is processed through the check run, users could make changes to the discount or terms amount until the payment was received. However, if the business processes only a partial payment, changing the discount or terms caused errors in the General Ledger. To prevent these issues, discounts and term changes are allowed on a billing entry until the first payment is made. After the first payment is received and the check run has completed, the application disables the $ Discount and % Discount fields in the Billing Entry form.

D-74288 - Cost Correction and General Ledger Reconciled with Currency Differential Changes : When Multi-Currency and Currency Differential are enabled and the amount of the currency differential changes, entering a cost correction to an item after the differential change used to cause General Ledger issues. We have corrected this by applying a currency differential to the Journal entry to ensure the items match.

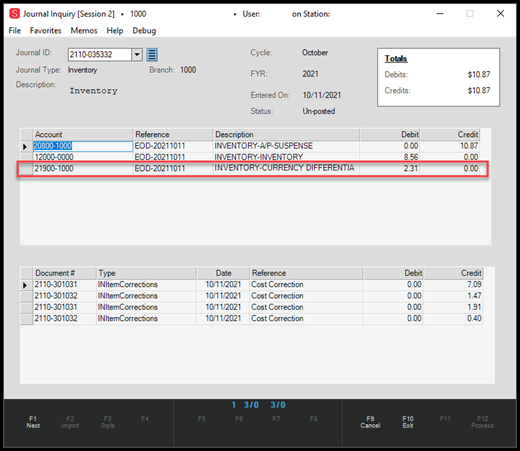

Journal Inquiry with Currency Differential Adjustment Highlighted

12.18.7

12.18.7

Fixed

D-60676 - Remote Client Printing of A4 Pages Now Prevents Extra Blank Page at the End of the Job : Some UK Customers reported that when they printed with A4-sized paper using the Remote Client, an extra blank page would go through the printer at the end of the print job. We have corrected this issue.

D-72286 - Reversing a VAT Adjustment from a Pending VAT Return : In the past, there was no way to delete a VAT adjustment after it had been submitted. We have added a new process that allows you to delete a VAT adjustment that has been added to a pending return. If you attempt to delete a VAT adjustment for a finalised return, an error message displays:

VAT Adjustment has been previously reported on a VAT Return. Reverse is no longer allowed.

Note: This process assumes that the application has UK regional and GBP currency settings and that the HRMC - MTD settings have been set appropriately. These instructions appear in the VAT Adjustment section of the Help System.

D-75046 - Cost Correction Now Includes Rebates in Correction Calculation : In the past, one of our customers noticed that when they processed a Received Item Cost Correction, only the Last Receipt Cost (or an optional Market Cost) was included in the cost correction. Rebates that were part of the original transaction were not applied. We have corrected this issue.

D-75071 - Exclude DIB BOPIS Items Command Working Correctly Now : When items in the DIB BOPIS e-Commerce store were removed (by selecting the Exclude DIB BOPIS check box), the site was not sending an update to Do it Best as expected. We have corrected this issue.

D-75308 - VAT Return Logic Updated based on HMRC Advice : In the past, when the application calculated the GL adjustment output, and it was a negative number, the application would add it to Box 5 incorrectly as a negative number. Since this VAT Return box requires an absolute value, we have corrected this issue to display a positive amount.

We have updated the logic in several places based on the advice we received from the HMRC MTD site. We validated the logic for retrieving VAT adjustments to ensure there are no duplicate lines for accounts payable bills. We have updated the logic to ensure that only documents within the submission period show basis amounts. We have validated that the application uses the end date of the VAT return period rather than the current date. We have updated the header logic to bring in VAT adjustments into the basis amounts based on GL Period, and AP Billed date. We have updated the logic to bring in partially paid AP Bills as well as closed ones for the reporting period. We have updated the VAT return body to include documents that did not have VAT on them, to ensure that documents that affect the basis only to show in the body.D-75583 - Branch Detail Mapping Issue No Longer Doubles VAT Payment in Billing Entry : In the past, when you selected the Branch check box in your General Ledger detail mapping and then modified an AP bill with VAT amounts, the application doubled the VAT payment required. We have corrected this problem to prevent this behavior.

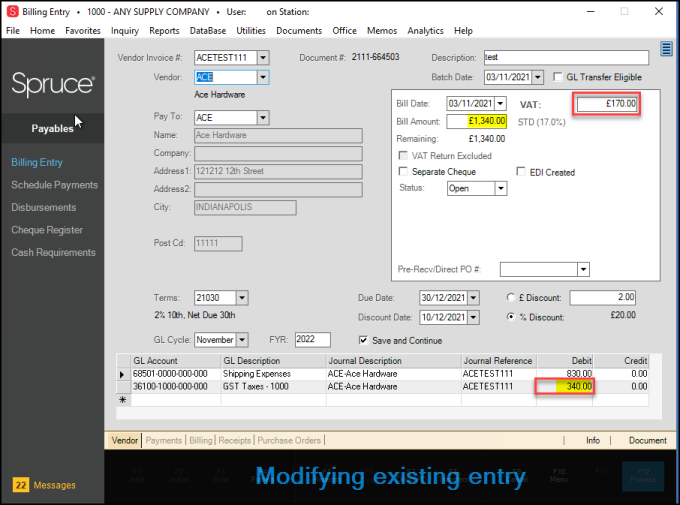

Billing Entry Form

12.18.8

Fixed

D-76427 - Viewing GL Account Details after Billing Entries are Complete : We have corrected an issue where, if you did not complete VAT payables mapping, you may not have been able to view GL Account details for completed billing entries. This was caused by an internal error, which has been corrected. After you complete the GL account change in Billing Entry, you can return to Billing Entry at any time and look up the invoice number you completed to review the GL account details.

D-75977 - Foreign Amounts Displaying Correctly in Schedule Payments : Although this information displayed correctly in the customer’s invoice and in the billing entry form, this information failed to display in the Schedule Payments form. We have corrected this issue. We have updated the Schedule Payments form to populate foreign amounts using the exchange rate on the AP bill.

D-75588 - Received Item Cost Corrections No Longer Resulting in Error : We have fixed the issue that occurred when a Received Item Cost Corrections entry caused a system error. The error was caused by a divide by zero exception, which caused the application to close. We have updated the logic in this form to prevent this issue from occurring, and now the Cost Corrections process normally.