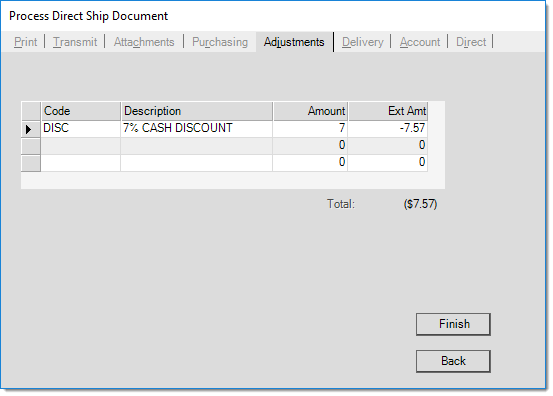

Direct Ship > Process Document > Adjustments Tab

Adjustments (ALT-J) are used for entering miscellaneous charges (fuel, tarping, etc.) to be applied to the Direct Ship upon invoicing. Up to 3 Point of Sale adjustments may be entered per transaction. Adjustments specified here will be retained with the Direct Ship order until invoicing ("Point of Sale" invoicing occurs when the Direct Ship purchase order is invoiced in Payables). The Purchasing (Alt-R) tab also offers another "Adjustments" tab that should be used for any adjustments specifically related to purchasing.

Adjustment codes must be defined before use and may be applied to pricing based on a number of both methods and apply choices. Codes are defined by using the Adjustment Code Maintenance form. This form is accessed from the Database drop down menu and is available from the Point of Sale, Purchasing, and Inventory areas. For more information about adding, modifying, or deleting adjustment codes see the topic Adjustment Code.

Adjustment codes can be designated for use with Manufacturing, Point of Sale, Purchasing, or Receiving. Both "Point of Sale" and "Purchasing" types may be used with Direct Ship transactions; however, separate tabs are used for each type. Point of Sale types may be designated as either taxable or non-taxable. Check with your local tax department(s) or a tax professional regarding the tax rules for your area and adjustments.