Manufacturing Market Adjustment Code

Use this manufacturing market adjustment code to use manufacturing as a profit center. Set the amount for this adjustment equal to any difference between the market cost for the manufactured item and the actual cost plus any other adjustments (not including this adjustment). Since you have control over the market cost for the manufactured item (market cost only changes if you adjust it), this allows you to manipulate the cost to include some degree of profit.

Understanding Cost CalculationsA Work Order's "Total Cost" is calculated as the sum of the extended current market costs of the materials used to manufacture each detail record (manufactured item). The Unit Cost is calculated as the Total Cost / Detail Quantity (the quantity on the work order for the manufactured SKU). The Adjustment Amount = Total Cost – (Sum of Actual Material Costs + Sum of Adjustments) *The resulting "MfgMarket" adjustment amount does not include Mfg Market types nor do they include any regular manufacturing adjustments that you do "not include in the market roll-up." There is a check box setting provided for Manufacturing type adjustments to exclude them from the market cost adjustment. |

It is possible to have a negative adjustment (profit) in certain cases. For example, if the market cost set too low, or during manufacturing there are added items or adjustments, these can push the manufactured cost above the desired market cost.

Adding or Modifying a Manufacturing Market Adjustment Code

To add a manufacturing market adjustment code:

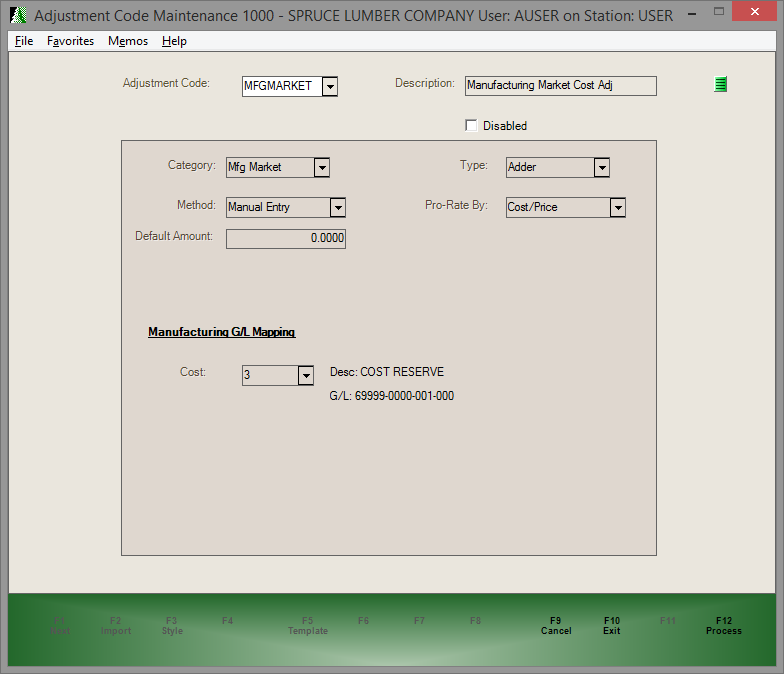

1. From the Main Menu, choose Manufacturing > Database > Adjustment Codes. The Adjustment Code Maintenance form displays.

2. Review the field descriptions below and complete the fields and selections to add or modify the manufacturing market adjustment for manufacturing projects.

Adjustment Code: Mfg Market Type

3. When your entries and selections are complete, choose Process (F12) to save the adjustment code.

Using the Adjustment Code Fields for Manufacturing Market Adders

Use the field descriptions below to learn more about creating an adjustment code for manufacturing market adders:

Adjustment Code

You can use this field to add a new Manufacturing Market adjustment code (by typing a new name in) or select an existing adjustment code to edit or delete it. When you choose this list from within an application area (in this case, Manufacturing), the list of codes is filtered based on their assigned category, so only the applicable codes display. If you are entering a new adjustment code, you can enter a full or partial description in the text area and then choose "Description" from the alternate menu.

Description

Enter a description to indicate the purpose of the code. This displays alongside the code whenever you choose the Adjustment Code list. The length of the description is limited to 30 characters.

Disabled

Select this check box to disable an existing adjustment code. Disabling an adder code prevents the code from appearing in selection lists, but does not remove the code from the application. You will still see this code referenced on documents and any transactions that have this code assigned to it. We recommend that you disable a Manufacturing Market code rather than deleting it.

Note: You can use the Menu Marker ![]() to delete an adjustment code; however, it's best to only do this when a code hasn't been used. Deleting a code removes information about the code permanently and can cause code descriptions to disappear from documents that referenced it. For this reason, we strongly suggest using the disable option in place of deletion whenever an existing code may have activity.

to delete an adjustment code; however, it's best to only do this when a code hasn't been used. Deleting a code removes information about the code permanently and can cause code descriptions to disappear from documents that referenced it. For this reason, we strongly suggest using the disable option in place of deletion whenever an existing code may have activity.

Category

Select Mfg Market from this list to add or display the Manufacturing Market adjustment code settings. This entry ensures that you can choose this code during manufacturing adjustments. This also sets default values for certain fields on the form.

Note: Changing the category on any existing code is strongly discouraged. If you modify this code, the fields on the form are set to default settings for the category. Even if the category is then changed back, any prior entries on the form and for the selected adjustment code will be lost. If the category is accidentally modified for an existing code, it's best to first Cancel (F9) and reselect the code to reload the actual settings in this case. There are currently five (5) categories: Purchasing, Point of Sale, Manufacturing, Receiving, and Mfg Market.

Type

The only type available for manufacturing (mfg) market is the Adder type. The field is read-only to prevent changes.

Method

The only method available for the Manufacturing (mfg) Market code is the Manual Entry type. The field is read-only to prevent changes.

Pro-Rate By

This entry is Cost/Price. In the case of manufacturing, adjustments are applied based on cost. The field is read-only to prevent changes.

Default Amount

Typically, you enter the default dollar amount or percentage for calculating the adjustment; however, it is not used with manufacturing (mfg) market type adjustments. The field displays a zero (0) dollar amount and is read-only to prevent changes. The actual amount of a manufacturing (mfg) market adjustments is calculated when manufacturing a product and is not manually set.

Manufacturing G/L Mapping

The General Ledger mapping for manufacturing must be done before you set up this adjustment. This mapping is found the detail mapping database located under the General Ledger area (select Manufacturing Costs). For manufacturing (mfg) market type adjustment codes, we suggest you choose an expense, cost of goods sold, or income account. The difference between the manufactured item's, or items', market cost and the sum of the materials and other adjustments* determines the amount credited to the specified account.

This type of adjustment isn't intended to represent any actual expense, such as labor, but is instead meant to "reserve" some of the cost as profit. Crediting an income account increases your income balance immediately when the goods are manufactured. The remaining income would be recorded at time of sale. Crediting a cost of goods sold or expense account reduces your cost of goods sold (or expenses) immediately when goods are manufactured. Either results in an increase to Net Income by the adjustment amount once the manufactured items are sold. In neither case would the margin shown for the sale (invoice) reflect the profit from the adjustment.