Verifone Point™

Verifone Point is VeriFone Systems’ semi-integrated solution for EMV bank card processing. Verifone Point is intended for retail use where a customer's card is present. It is not intended for processing card transactions where the customer's card is not present. Card contracts (tokenization) may still be processed. Any existing card contracts would have to be added to the new account. A new account is necessary for processing. The instructions for tokenization are the same as for Verifone PAYware Connect. For more information about card contracts (tokenization), click here.

IMPORTANT NOTE: For security reasons, some capabilities that were available in the past are no longer supported. For similar reasons, ECI Support cannot install or load files for Verifone Point devices, but we will continue to assist you in troubleshooting any issues you may find while using them.

What is EMV?

EMV stands for EuroPay, MasterCard®, and VISA®. The term is commonly used when referring to new chip card technology and new PCI Compliance Standards.

What is PCI DSS Compliance?

PCI stands for Payment Card Industry, and DSS stands for Data Security Standard. Verifone Point and supported hardware can help your company remain compliant with the latest card industry standards. These standards are assigned version numbers as they evolve. The latest version is 3.1. For more information about the standards, please visit:

https://www.pcisecuritystandards.org

It's important to point out that these standards are not laws. Standards are defined and enforced by the credit card industry and not any government entity.

How is EMV chip technology more secure?

Cards with a microchip communicate with the card terminal in a more secure fashion with encrypted data and are more difficult to duplicate than a magnetic stripe.

Cards with a chip are inserted into a card reader slot on the device at the end of a transaction. The device communicates with the card and the processor to authenticate the card over a secure (encrypted) connection. Card information isn’t passed through the Spruce software and communication between the device and software is kept at a minimum. All actual card processing occurs directly between the device and VeriFone System's PAYware web service over a secure connection.

Because the device is entirely responsible for communication, the level of integration with the Spruce software is minimal. This alters Point of Sale processing for this device.

Point of Sale Processing using Verifone Point

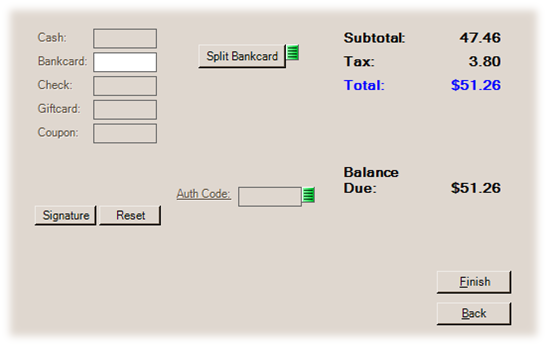

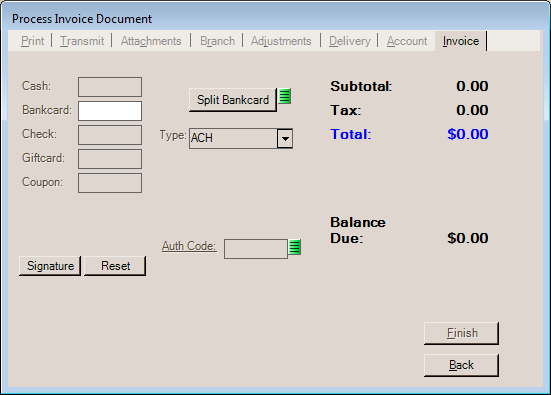

Point of Sale processing is different when using a Verifone Point device. The level of communication between the Spruce software and device is much lower for security reasons. The biggest difference from a use standpoint is that we removed most bankcard fields from the Process forms, particularly those provided for manual card entry. When the item display feature is "on," customers can swipe or insert their card at any time. When "item display" is off, the customer waits until the cashier chooses either Finish (F12) key or uses the Split Bankcard button (as when the customer is paying using more than one card).

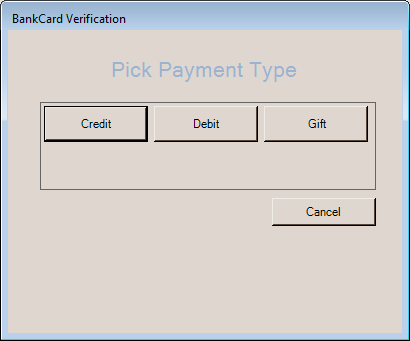

If you are using the pad with stored value or self-managed gift cards, the process is also different. Cards are now activated after any payments are processed (which possibly may include bankcard amounts). There are special requirements for gift cards using the Verifone Point MX915 device for swiping the cards for sale or payment use; however, this is generally not required. In these cases, there can be an extra step for customers that allows them to select a "card type" (credit, debit, or gift).

Sales

For Sales transactions, there is no need to specify a bankcard amount if the customer is paying the entire balance using one card. The Cashier can simply click the Finish (F12) key on the Process form to initiate the credit card processing. This action displays the Bankcard Verification dialog, which will close automatically after the card processing is completed. Cashiers only need to interact with the dialog if a problem is reported. If the customer wants to cancel their transaction (to use a different card, etc.) it's best to ask the customer press the Cancel key on the device rather than initiating the cancellation from the dialog (in the software).

Please see the Customer Experience section of this topic for additional information.

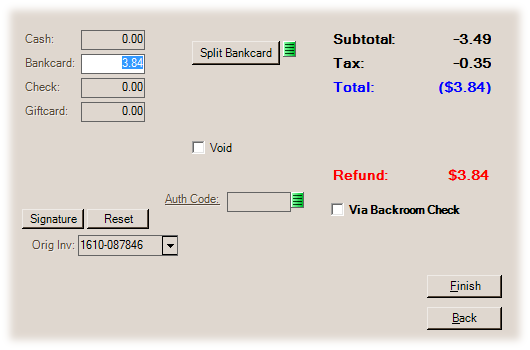

Credits/Return Sales

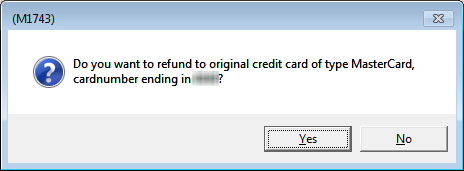

When issuing a return (negative sale), select the original invoice and, if the original sale involved a bankcard, a prompt may appear asking if you want to credit the original card. Depending upon your parameter selections for the handling of returns, the selection of an original invoice happens either at the point of item entry (in the data grid) or on the Process form.

Debit Cards & ReturnsThis prompt does not appear when the original transaction involved a "debit" card. In the vast majority of cases, processors do not permit returns to debit cards. In some cases, the "manual entry" process may work to issue a "credit" to a debit card; however, in most cases, returns must be issued as cash or processed as credit rather than debit. |

-

If the cashier chooses Yes, the application will attempt to issue a refund to the card that was originally used after the cashier selects Finish (F12) on the Process form.

-

If the cashier responds No, you can still issue a credit using the token from the original sale for the reversal. This is processed independently from the card device and the card does not need to be present.

For any other type of processing, the either the card must be or is considered to be present.

When the transaction's original card is not used for issuing the credit or void, you may see the following prompt.

Since you cannot credit or void a transaction using a debit card, you can pick either Credit or Gift.

Another return /credit option is to use the Void check box. This check box is only available when an original invoice that was paid by credit card has been selected. Check this check box to void the original sale rather than issue a credit. For a void to work, the transaction total must match the original sale total paid by the card. Voiding will not work if the customer isn't returning the entire purchase. Void transactions usually do not incur transaction fees by the processor, whereas credit transactions do.

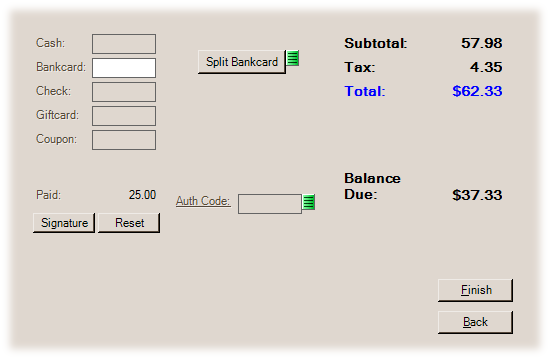

Using the Split Bankcard

When a customer needs to apply the balance to more than one credit card, you can use the Split Bankcard process to do it.

To apply the balance to more than one card:

1. In the Bankcard field, enter the amount to be charged to the first credit card.

2. Choose the Split Bankcard button.

3. Ask the customer complete processing on the pad for the first card.

After the card has processed, the Balance Due field updates to show the remaining amount.

4. If additional cards are required, keep following steps 1 through 3 until you get to the last card.

When you are ready to process the final card, continue to the next step.

5. In the Bankcard field, enter the remaining amount to be charged to the next credit card.

6. Choose Finish (F12) and complete the final card processing.

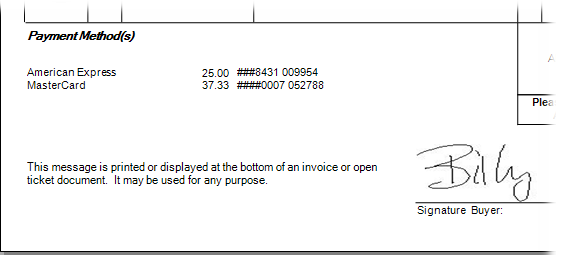

The resulting document will list each card type, amount, the last four-digits of the card number, and transaction ID.

Document with Multiple Card Payments

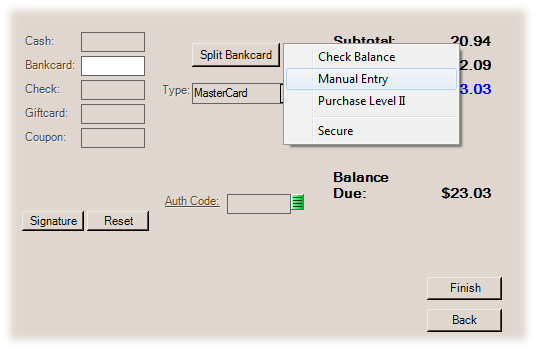

Is there a way to enter a customer's card manually?

Yes, this is possible. This is intended for times where a customer's card is present but the device cannot read it. You can use the Manual Entry process on the device or you can use the PAYware Connect console.

Both the console and manual entry options, as well as your Verifone Point account, are intended for use in "card is present" situations only. If your company frequently processes either phone or internet orders, one option is to create and use a different account intended for MOTO (Mail Order - Telephone Order) for this purpose (either with Verifone or another provider). In this case, you'd process the card independently of the software and then use the Authorization code field to indicate the confirmation code you received from your selected processor.

The number of options presented can vary based on your parameter and device settings.

Manual Entry Process

When you use the Manual Entry process, the device is still responsible for authorization and communication. Companies that use Manual Entry for "card not present" situations (such as phone orders, etc.) are taking a significant risk. The capability you have to process EMV (chip cards) won't protect you in the event of fraud when card data isn't processed using the card's chip. Any handling of card information by your company places your company in "scope" for PCI compliance.

To trigger the Manual Entry process:

In the Process form, choose the Menu Marker  and select Manual Entry from the list.

and select Manual Entry from the list.

Then, choose Finish (F12) and follow the prompts provided.

Customers enter the card number, expiration date, and CVV2 number and confirm their entries. After all the card information is entered successfully, the device prompts the customer for a signature.

Manual entry may automatically be triggered if after several attempts a customer's card cannot be read by the device. The Manual Entry check box is also provided on the Bankcard Verification dialog box during pad interaction in some cases.

Any use of the device for situations where a customer's card is not present isn't suggested. Instead, we suggest using a separate method of processing intended when a customer's card isn't present (on-line card processing account specifically intended for MOTO transactions, etc.).

Manual Card Entry

Merchant Console

You access the PAYware Connect merchant console using a web browser. This merchant console gives you a way to establish "card on file" contracts, manual transactions (void, etc.), and reporting. Again, use of the console for processing "not present" card transactions is equally risky. These card transactions do not automatically tie back to the Spruce application. If you choose to use this method, the authorization could later be associated with the transaction using the "voice authorization" text area provided on Process forms. Again, even this method is intended for cases where a customer's card is present, but cannot be read (not for MOTO).

Your company can also create "card contracts" (tokenization) which may be linked with accounts. If you choose to do this, we suggest having some type of written agreement signed by the card holder on file giving your company permission to charge their card when accepting orders via their card. For the greatest security, it's best to have the customer present with their card and proof of identity when creating the contract. In this case, the card contract would be able to be used for processing card transactions as long as the station has a pad device (stations without a pad device cannot process any card transactions).

Additional Menu Marker and Process Form Options

When the Bankcard Remittance panel is active, a context Menu Marker  is available next to Split Bankcard button on the Process form. This is not visible if the menu has been marked as Secure by your company and you (as a user) don't have security access to view "secure" markers. It is possible to select more than one menu item. A check box appears next to selected menu items. Selections are not applied until the Cashier chooses the Finish (F12) button. The number of options presented can vary based on parameter and device settings.

is available next to Split Bankcard button on the Process form. This is not visible if the menu has been marked as Secure by your company and you (as a user) don't have security access to view "secure" markers. It is possible to select more than one menu item. A check box appears next to selected menu items. Selections are not applied until the Cashier chooses the Finish (F12) button. The number of options presented can vary based on parameter and device settings.

Check Balance

In the Bankcard Remittance panel, choose this Menu Marker  option to verify a gift card's remaining balance.

option to verify a gift card's remaining balance.

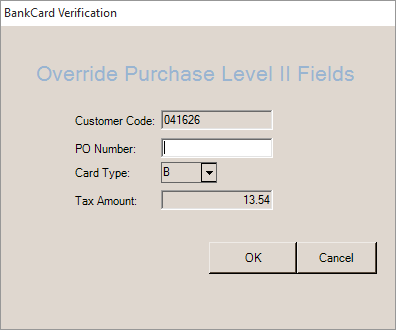

Purchase Level II

Use this feature to override the Purchase Level II data that would be transmitted with the card. This option is only listed if Purchase Level II data has been enabled for the branch's Verifone Point settings (these settings are accessible by Support personnel only).

Card Type List

If the Card Types parameter is enabled for Point of Sale, there is a Type drop-down list that includes additional card types that are not accepted for your card interface's processing. The list allows you to select a card or payment type. For example, your company may define and use a Point of Sale card type for ACH/EFT payments that are done independently from any card processing on the pad. Selection of a card type that is not enabled for use with card processing will bypass the signature pad device. In cases where the list of valid Point of Sale card types matches those used with card processing, no drop down will be shown.

Parameters are used to determine which card types your card interface accepts vs. which card types you want available for use at Point of Sale. Card types enabled for card processing must also be enabled for Point of Sale; however, you can have card types enabled for Point of Sale that are not handled by the card interface. Card types for your card interface (if any) are enabled on the Software tab in (Maintenance > Database > Parameters), which can only be modified by Support personnel.

Auth Code

Use the Auth Code (authorization code) field to process a bankcard type payment method when you want to bypass any integrated or device-based card processing. Here you can enter the authorization code provided by the transaction processor, so it can be stored with the transaction. Entry of the authorization code is disabled unless you enable the option using the context menu. Direct manual card entry is not permitted directly from the Spruce software. After you specify an authorization code, the device does absolutely no further card processing without additional steps taken by your company. The authorization code is just for your own reference for cases where an authorization for a card was received independently and does not trigger any type of card processing later.

When the processor has processed a card but the authorization returns a decline or times out, you may be prompted to enter an authorization of ACCEPT or FORCE when you attempt to pre-process the card. These messages appear as follows:

"Accepting the Duplicate will allow processing this transaction by the application even though it has only been approved by the bank once. Type ACCEPT in the box to confirm you understand and wish to continue."

(Note: If you follow the directions to ACCEPT, the transaction will process but not charge the card again.)

"Forcing the duplicate will cause this transaction to be charged to the account even though the same amount has been charged previously. Type FORCE in the box to indicate you understand and wish to continue."

(Note: If you follow the directions to FORCE the transaction, the customer's card will be charged again for the same amount.)

Customer Experience

This section details the interaction between the Cashier, the Customer, and Verifone MX915 signature pad during a Sales transaction. For other transactions and payments, the process can differ slightly. You may need to manually enter the bank card amount, for example.

•While the pad is in an idle state, a series of "welcome" messages are displayed.

Verifone MX915 - Verifone Point (Welcome)

•If Item Display is enabled for the station, the pad displays items after the Cashier scans or enters the first item. If the Cashier cancels the transaction, the pad returns to the "Welcome" screen. Items without a description will not display or be included in totals; however, the confirmation total after the customer swipes their card will include the amount.

Verifone MX915 - Verifone Point (Item Display)

•Changes made to items are reflected immediately on the pad and update the original item row (not a modification or delete row on the display). If for some reason, there is a communication or timing issue and the pad's display doesn't reflect a change, choose the Reset button on the Process form to refresh the display. If the Customer or Cashier cancels a card transaction after the device is activated for processing, the device will redisplay the items when the "Bankcard Verification" dialog closes.

•After entry of the first item, the Customer can insert, swipe, or tap their payment card/device at any time. If they swipe a chip card on an EMV enabled terminal (pad), a prompt appears to ask them to insert the card instead (an image of this can be found later in this topic).

Important!One difference between how Verifone Point functions, as compared with previous solutions, is that the Spruce software is not notified when the pad receives a swipe. Swiping a card will not automatically set the remittance method to bankcard. If no other payment methods and amounts are specified when the cashier selects Finish (12) from the Process form, we assume that the remittance is bankcard for the full amount of the transaction. |

•After the Cashier selects Process (F12) to display the Process form, the Cashier will encounter one of two situations:

▪A default remittance is already specified.

▪No default remittance is specified.

If no remittance is specified, the Cashier can just choose the Finish (F12) button to activate payment processing on the pad.

In cases where some other payment method is indicated, the Cashier can either clear the payment amount or select the Reset (F10) button.

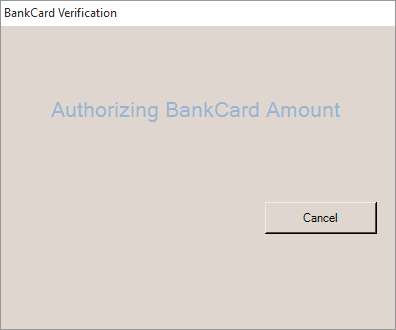

After the user selects Finish (F12), the Bankcard Verification dialog box will open on the station. This window provides the Cashier with any response messages returned from the pad device. In cases where there's a card read or other error, this may offer a Manual Entry check box that prompts the Customer to enter their card information on the form.

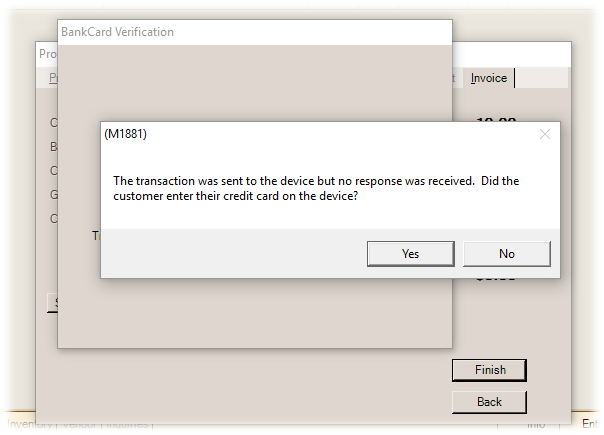

BankCard Verification (Authorizing BankCard Amount)

The dialog box close on its own, so Cashiers should not click Cancel or any other button unless there's a error or denial. Clicking Cancel after the Customer's card may been read or processed produces another prompt asking if the card information was entered. It's best to click Yes if there's any doubt. Then, redo the transaction.

Cancel Warning

-

If the cashier clicks Yes, the device will attempt a void on the card transaction;

-

If the cashier is absolutely positive that no card entry or processing occurred, they can click No.

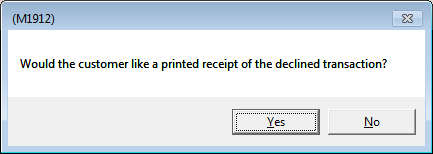

If the card was processed, and the cashier clicked No, the transaction won't be voided automatically even if they ultimately cancel the transaction. A declined receipt may print or you may receive a second dialog prompting whether the Customer would like a declined receipt after responding to this prompt.

•At this point, and if "in-house" gift is enabled for the device, the pad display changes and prompts the Customer to select a payment type (credit, debit, gift card, etc.); otherwise, the pad prompts the card holder to swipe, insert, or tap their payment card or device. The options provided can vary based on the settings selected for the device. For chip cards, Customers should select "debit" for a debit card even if they want to process it like a "credit" card. For chip cards that allow this, an additional prompt will appear asking the Customer how they want to process their debit transaction (scroll down for more information on this).

Verifone MX915 - Verifone Point (Select Payment Type)

If enabled on the pad, you may see a Pay Balance button or additional buttons for handling store cards, etc. The Pay Balance button is used for indicating some other payment method (similar to canceling the card transaction) and returns the Cashier to the Process form. In this case, the message Cash Payment is displayed in the Bankcard Verification window.

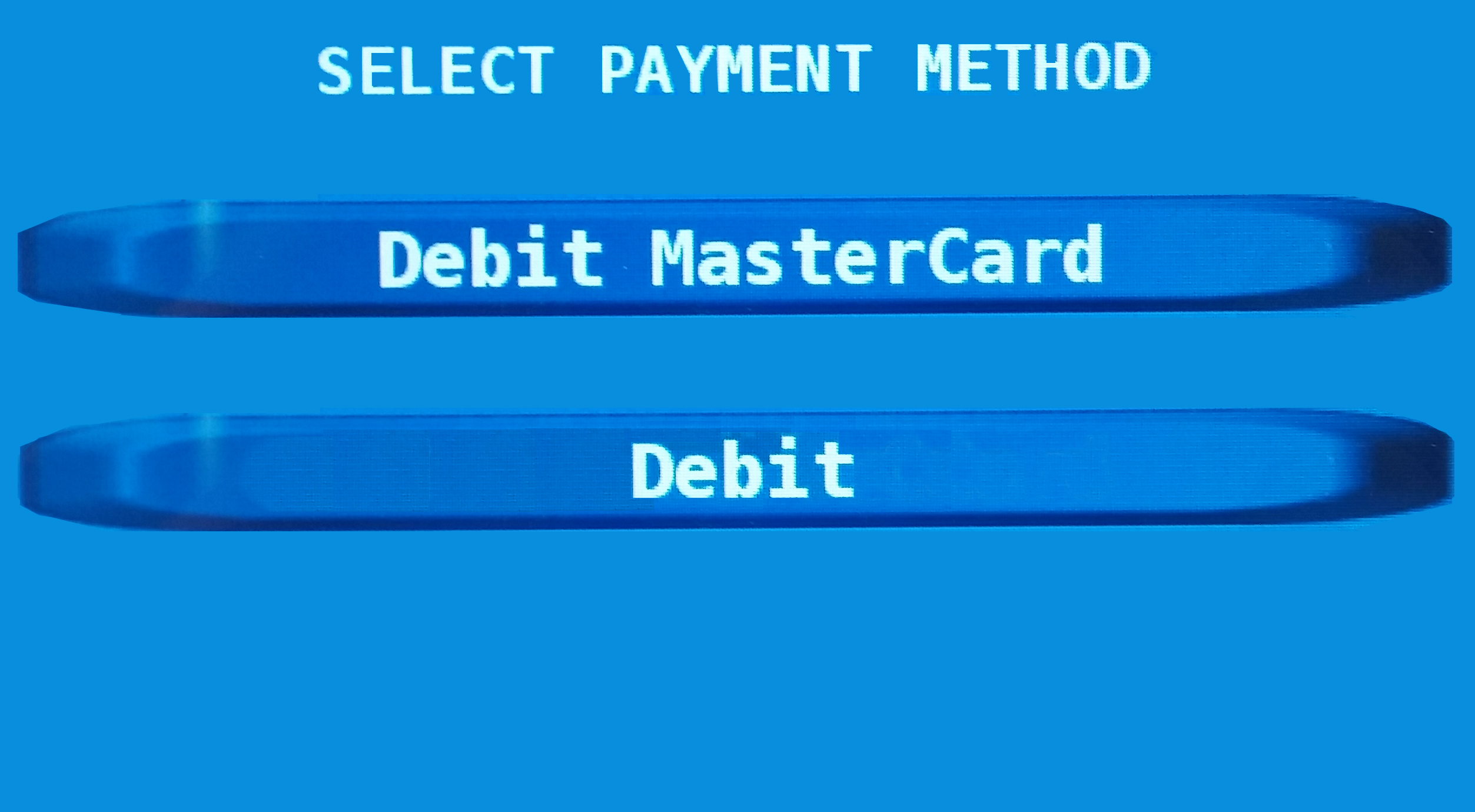

•When a Customer's card has more than one AID (application ID) assigned, an additional prompt can appear. This usually only happens with debit cards, and means that the card allows itself to be processed either as debit or debit via "credit." The wording of the options can be confusing; however, this is what's read from the card's chip. Usually, both options will say "debit;" because they both will eventually result in a debit to the card holder's bank account. The "debit" selection is processed as purely a debit transaction, and the other option ("Debit MasterCard," for example) will be processed through the credit card processor first.

Multiple AID - EMV Chip Card Prompt

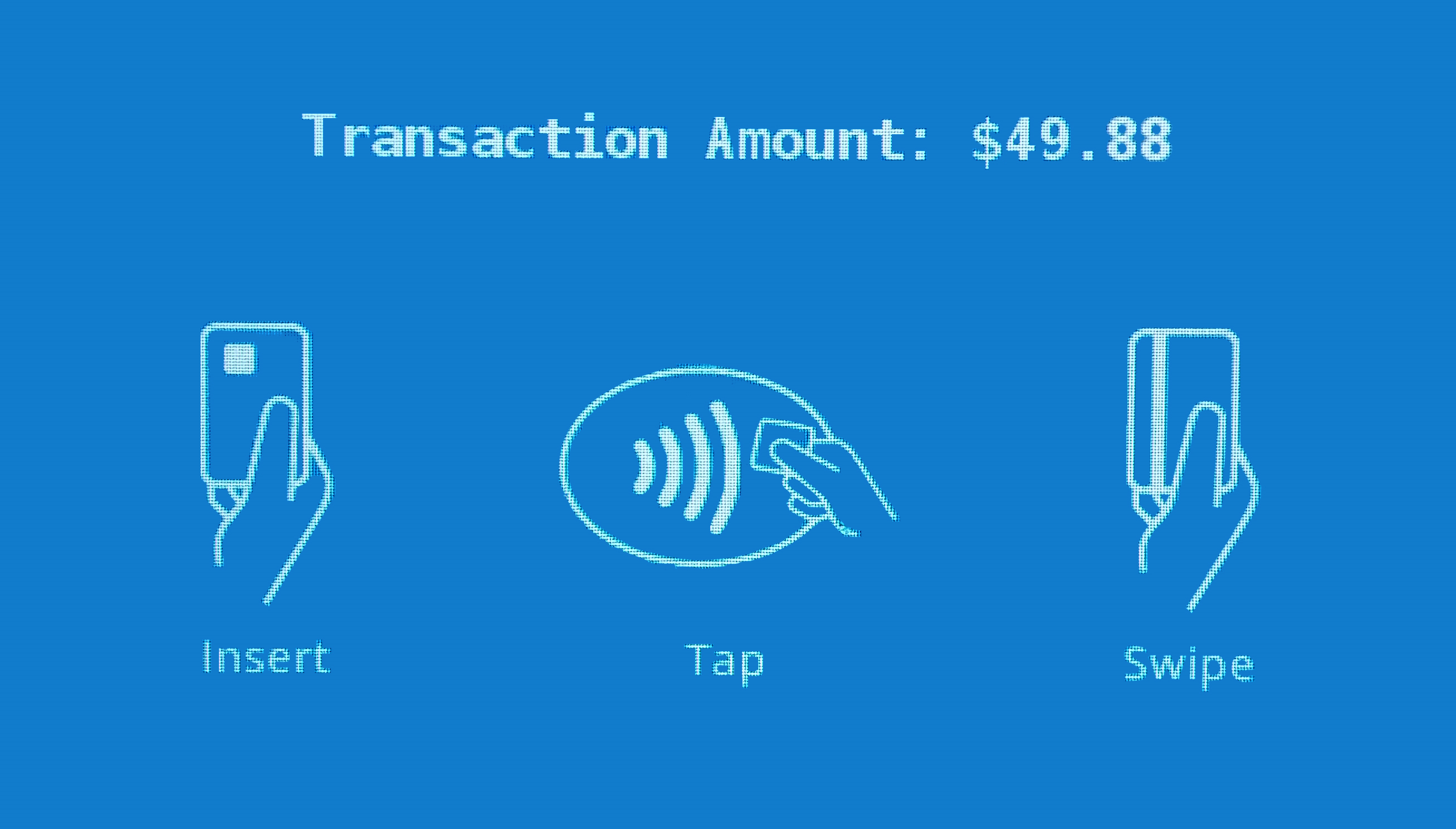

•If the Customer hasn't previously swiped or inserted their card and after selecting a payment type, the transaction amount is displayed and the Customer is prompted to either insert, tap, or swipe their card.

Insert, Tap, or Swipe Prompt

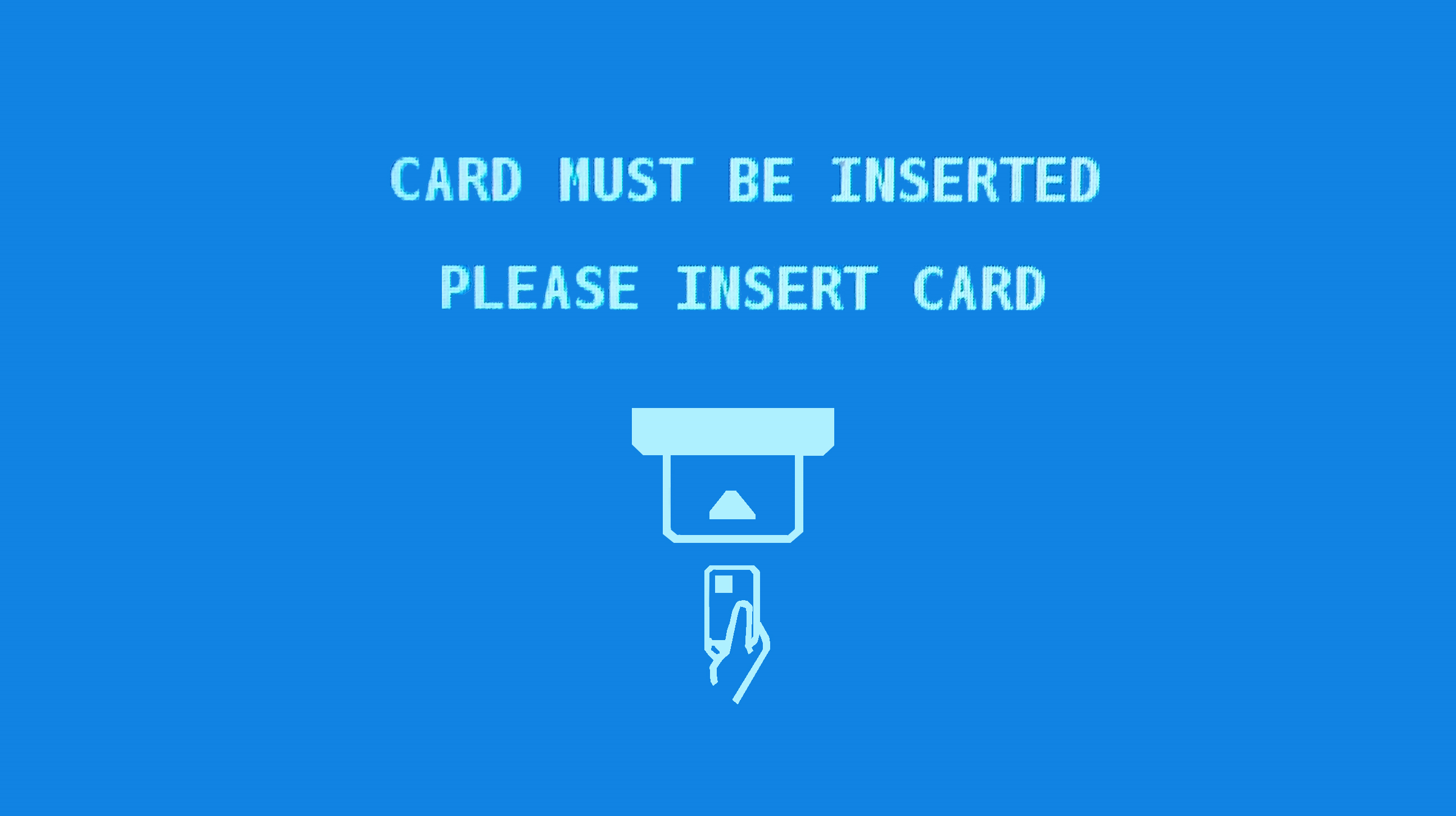

•If the Customer swipes their card and it has an EMV chip, the device will prompt them to insert their card instead.

EMV - Please Insert Card

•The insert option is only displayed if EMV has been enabled for the pad device. This would only be done after the processor enables EMV processing. If EMV is enabled, and the Customer has a chip card, they are required to insert their card.

•Once the card input is complete, the message Processing... Please Wait appears briefly.

Verifone MX915 - Verifone Point (Processing)

•Depending upon the type of input, as well as settings for signature limits, the Customer may or may not be prompted for additional action such as a signature or debit pin entry. Signatures are not generally required for EMV chip cards. When a signature is required, the Accept button won't display until they start signing.

Verifone MX915 - Verifone Point (Please Sign)

•Assuming the transaction is approved, a confirmation message displays on the device window.

Verifone MX915 - Verifone Point (Approved)

•At this point, the card transaction is complete. The process form will close unless the card being processed was part of a split bankcard transaction. In the case of a split, the Process form remains active for further processing.

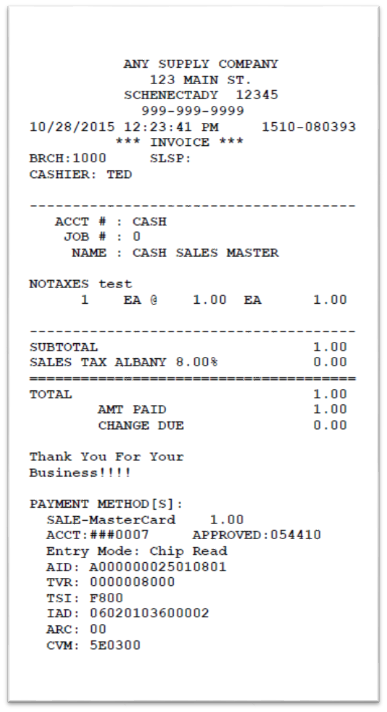

Document Changes for Verifone Point Transactions

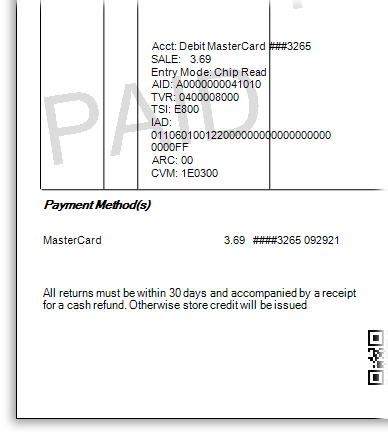

Cash ticket receipts and application documents are required to display additional information regarding card transactions for EMV transactions than for swiped cards. Companies migrating to Verifone Point from VeriFone PAYware Connect will notice some differences after they begin doing EMV transactions. Below is an example of a cash ticket receipt for a Verifone Point transaction for an EMV (chip card) transaction. Less information is required for non-chip transactions, so the level of detail can vary by the transaction.

|

Please Note: if an EMV chip card is declined, or the transaction is canceled after the card was inserted, we are sometimes required to print a special "declined" receipt. This is required for certain types of cards. For MasterCard, the Customer can decline the receipt (a prompt appears in this case). For American Express, the "declined" receipt is always printed. Printing, in this case, occurs immediately at time of the decline, and no prompt is needed. There is no need to complete processing for the receipt to print. The decline receipts are only printed in cash ticket format. No decline receipt is required for VISA or Discover card; however, the prompt may appear anytime the card type wasn't identified. This is only a requirement for EMV processing, not swiped cards.

|

|

|

Troubleshooting

The most common reason for pad issues are IP address conflicts. These can make the pad disconnect frequently, cause slowness, and create inconsistencies with the item display. To test, ping the pad's assigned IP address from the command prompt. It should show a valid reply while plugged in. Please note that the IP addresses in the following examples will not match your devices or network; they are provided for examples only.

A valid reply (success) would be indicated by the following (example):

C:\Users\anyuser>ping 10.9.0.123

Pinging 10.9.0.123 with 32 bytes of data:

Reply from 10.9.0.123: bytes=32 time=2ms TTL=64

Reply from 10.9.0.123: bytes=32 time=1ms TTL=64

Reply from 10.9.0.123: bytes=32 time=1ms TTL=64

Reply from 10.9.0.123: bytes=32 time=1ms TTL=64

Ping statistics for 10.9.0.123:

Packets: Sent = 4, Received = 4, Lost = 0 (0% loss),

Approximate round trip times in milli-seconds:

Minimum = 1ms, Maximum = 2ms, Average = 1ms

An invalid reply (fail) would be indicated by results similar to the following:

C:\Users\anyuser>ping 10.9.0.123

Pinging 10.9.0.123 with 32 bytes of data:

Reply from 10.9.0.92: Destination host unreachable.

Reply from 10.9.0.92: Destination host unreachable.

Reply from 10.9.0.92: Destination host unreachable.

Reply from 10.9.0.92: Destination host unreachable.

Ping statistics for 10.9.0.123:

Packets: Sent = 4, Received = 4, Lost = 0 (0% loss),

Next, unplug the unit's network cable and ping that address again. If the ping succeeds (meaning it still receives a valid reply), there is another device using the same address. If no other device is using that address, it should return a failure or invalid reply.

Gift Card Processing

Verifone Point

When a Customer uses a gift card for payment on a station with a Verifone Point pad device, self-managed or in-store cards are processed the same as a bank card transaction. The Cashier would enter the amount of the gift card in the Bankcard field and choose the Split Bankcard button. The Customer chooses the Gift Card option on the pad device and swipes their card. Your company can determine the actual wording on the device for the "gift" option. After the gift amount has been applied to the balance, the tender method will change from bankcard to gift card. To scan additional gift cards for the same transaction, enter the new amount in the Bankcard field again, and process the next card. The gift card total will increment with each card. In some cases, MX915 device settings may need to be adjusted to prompt Customers for a card type before continuing (see below).

Using Gift Cards with Verifone PointWith Verifone Point, self-managed gift cards may require different processing depending upon the type of data on the magnetic stripe of the card. Usually, the MX915 device with Verifone Point allows the Customer to scan their card at any time after entry of the first item during a transaction (or insert the card if it has a chip and the terminal/processor is EMV is enabled... which does not apply to in-store gift cards). When a card stripe (track 2) is read by the device, the device encrypts the data from the card whenever the card's number matches the numbering for any known credit cards. It's best to not start your gift card numbers with 3, 4, 5, or 6 for this reason. If the card's number doesn't match any known credit/debit card types, it is not encrypted. In order for you to use an MX915 device with Verifone Point for swiping in-store gift cards, the card number cannot be encrypted and therefore cannot match any known numbering scheme used for credit/debit cards. Another aspect of this is the expiration date of the card. If no expiration date is included with the magnetic stripe data on the card, the card swipe won't be accepted unless the customer has already selected a "gift card" option prior to swiping the card. Most MX915 pads are not configured to ask for a method of payment before swiping is allowed. In order to use self-managed cards without an expiration date on the stripe data, the device must require selection of a card type (credit, debit, or gift) prior to the card being swiped. Settings on the pad can be changed to do this upon request. If you have access to the pad's device settings (not in the Spruce software), this is found on the Administration tab, Config, Config.usr1 settings, and is the "cardreadscreenfirst" setting which should be an "N" to prompt for a card type first. You must reboot the pad after any changes. The above applies to sale of gift cards as well. A Verifone MX915 model will only recognize a gift card swipe during sale if the card number doesn't match a valid credit card number and the card's magnetic stripe has an expiration date in the data. The expiration date is indicated on the card data after the card's number preceded by an equal symbol, the year-month (YYMM), and suffixed by a question mark. Expiration dates aren't enforced by the application, but it's best to select an expiration date in the distant future. |