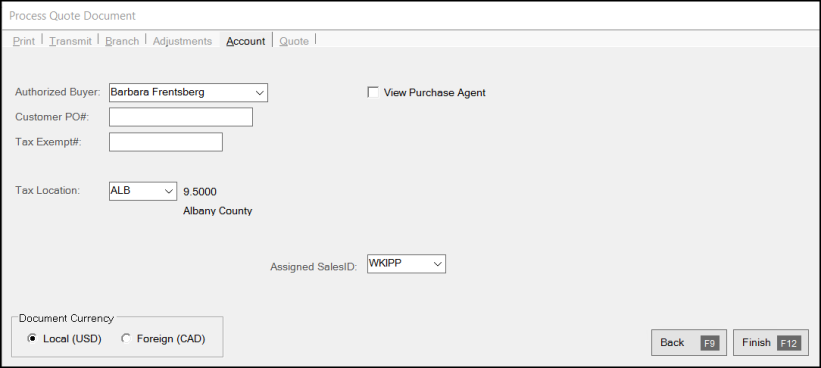

Process Quote Document > Account Tab

You can use the Account tab (Alt + A) to select an authorized buyer, view a purchasing agent's picture, enter the customer's purchase order or tax exempt ID numbers (if appropriate), and view or change the tax location. The application stores this information with the quote for processing later so you don't have to re-enter it later. You can change this information later if it is different when you process the quote as a sale, an order, a ticket, or before you create the invoice.

Authorized Buyer

The Authorized Buyer refers to the purchase agents assigned to an account or job. If either the account or job has purchase agents defined, the selection (or entry) of this list is required. If an "Enter Name" purchase agent exists on the account or job, manual entry of a name will be allowed; however, if not, you must pick an existing name from the list.

Manual entry of a name is allowed if no purchase agents are defined for either the account or job; however, the names entered are not saved with the account or job for future use. The application retains the name you entered and displays on the Quote document.

You can use the View Purchase Agent check box to display a photograph of the buyer (if the image has been saved to the database). When an image is available, the text "Picture on File" appears below the check box (unless the image is already being displayed). Using images can help verify the identity of purchasers.

Customer PO#

In the Customer PO# field, enter the PO number of the ordered materials if the quote requires materials that are not currently in stock. This field is particularly useful for tracking quotes for companies and government agencies that require transactions have an associated purchase order. This field may be required when an account or job has a Require PO setting. You can assign default purchase order numbers to an account or a job.

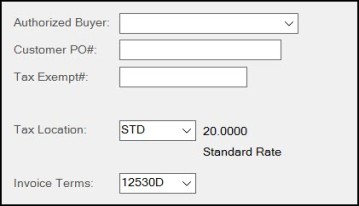

Tax Exempt #

If an account is exempt from paying sales tax, they typically supply some sort of documentation/certificate that contains a tax exempt ID number. You can save this tax exempt ID with either the account or job, or both, or you can enter it manually during a Point of Sale transaction. When a tax exempt ID number is specified, the application does not apply sales tax to the transaction (except when the transaction includes "always" taxable items). Tax won't be charged on taxable items regardless of the "taxable" status of the location is indicated. This is why "exempt" sales totals may appear with taxable locations on sales tax reports. Always taxable items are charged sales tax regardless of the account's exempt status (as the transaction may include "luxury" type items such as candy, soda, etc.).

In cases where an account is tax exempt, but assigned to a taxable sales tax location, we formerly used the account’s tax location regardless of delivery status. Due to the possibility that “always” taxable items could be involved in a transaction that is not being delivered, we have changed this logic. Now, if the account is tax exempt and the transaction does not include a delivery, we use the branch’s default tax location and not the account’s/job's. In the case of a transaction's delivery, the account/job’s tax location would still be used. This helps to ensure that “always” taxable items are being taxed at the proper rate and for the correct jurisdiction. If the account is assigned to an exempt tax location as well as an exempt ID number, both will be used for the Point of Sale transaction regardless of the delivery status.

Having a tax exempt number does not necessarily change the tax location automatically. In some areas, it will be best to assign exempt customers to a tax exempt location for tracking purposes. In others, having a mix of taxable and exempt sales for the same location is acceptable. This may be a requirement or just a preference depending upon your location.

Tax exempt numbers are printed/displayed on most Point of Sale documents and can be assigned to an account or job so that they don't need to be manually entered during Point of Sale transactions.

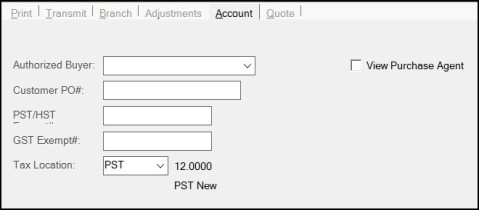

GST Exempt #

GST Exempt #

For Canadian businesses, the GST Exempt# field also displays. Use this field to add a tax ID number used for exemption from the GST or "Goods & Services Tax." In some cases, the provincial tax includes the GST, in others it does not.

Tax Location

This is the tax location used for calculating sales tax for the Quote. Tax locations are assigned a percentage the application uses to calculate sales tax, based upon the taxable total of the transaction. In the case of Quotes, the tax is an estimate and may change due to later modifications to the transaction. If the account or job specifies a tax exempt number, the sales tax percentage will be set to zero regardless of the normal percentage assigned.

The tax location is changed automatically in some cases. Tax locations may be assigned to accounts and jobs; however, these are usually only used in cases when a delivery is designated, a tax exempt number is also linked with the account and/or job, the tax location is always exempt, or the tax location is for a designated development (empire) zone.

For delivery orders, the tax location can be linked with a zip (or postal) code. If the delivery zip/postal code is different from the current tax location and the sale is not exempt, the tax location will change to match the zip/postal code's assigned tax code.

Note: When you change the tax location on this tab, it also changes the tax location used in the Quote

Invoice Terms

If shown, the Invoice Terms list shows either the job or account's default POS Inv Terms code and is only available for open item, charge accounts. The Invoice Terms code specifies the discount eligibility period and percentage for the account or job and specifies when a particular invoice (sale) will be assessed finance charges. You can modify this code before invoicing the transaction. Terms invoices are not aged any differently than other invoices. Invoice Terms for Point of Sale is an optional feature that must be enabled via a parameter before use. Terms are not applicable until a transaction is finalized (invoiced).

Point of Sale (POS) Invoice Terms